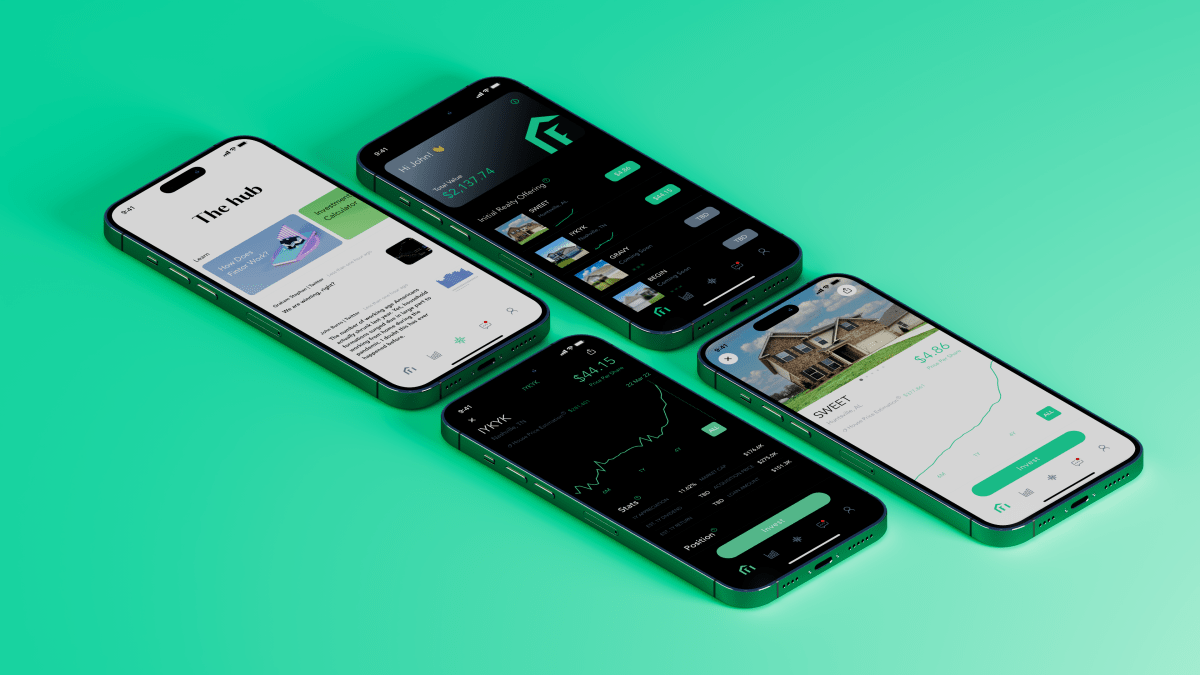

Fintor, a fintech startup making it easier for non-accredited investors to invest in real estate properties, has just launched its mobile app for both iOS and Android. It also just raised a $6.2 million extension funding round from its existing investors, including Public.com, Hustle Fund, 500 Global, VU Ventures, Graphene Ventures and angel investors such as Manny Khoshbin, Andy Madadian, Cindy Bi and Marcus Ridgway.

This latest round values Fintor at $80 million, founder and CEO Farshad Yousefi exclusively told TechCrunch. With the fresh funding, Fintor says it has now raised a total of $9 million from investors.

The Palo Alto, CA-based company is qualified under the U.S. Securities and Exchange Commission (SEC) Regulation A to offer investors fractional shares in properties it owns. It does this by issuing shares of LLCs that own the underlying properties, Yousefi explained in an interview.

Yousefi started the company in early 2021 with his co-founder Masoud Jalali to address a growing demand they had noticed among Gen Z and millennials to invest in real estate, an asset class that has often been inaccessible to everyday investors who cannot always afford to purchase properties whole.

Fintor enables its customers to invest in properties with as little as $5, according to Yousefi. The platform currently offers shares in single-family residences in states such as Georgia, South Carolina, Texas and Alabama, and Yousefi said it plans to enter 20 different markets by the end of 2022.

Eventually, Yousefi said, he hopes to build Fintor into an all-encompassing real estate platform by offering multifamily, industrial and other types of properties to investors.

It’s a competitive market, with startups including Landa, Nada and Arrived Homes, all of which have been covered in TechCrunch before, seeking to democratize access to real estate investing.

Yousefi highlighted a few different aspects of Fintor that help it stand out.

First, unlike many other real estate investment platforms, Fintor operates a secondary marketplace where individuals can place bid and ask trades on properties after the properties have been listed on the platform for over 90 days, Yousefi said.

The second differentiator Yousefi highlighted is Fintor’s focus on content promoting real estate literacy, which is specifically targeted to the Gen Zs and millennials who comprise Fintor’s target customer base. The app provides walkthroughs and educational modules that teach users how to analyze real estate deals, Yousefi said.

Fintor aims to stay operationally lightweight, Yousefi said. The company outsources its property management function to an external provider rather than trying to do that in-house, he explained. By outsourcing property management, Fintor is able to focus solely on its core mission of making acquisitions with strong returns and fractionalizing those assets to investors.

Yousefi added that he is not concerned about having competitors because of the newness of the niche. He said that other companies are helping Fintor with the broader mission of educating people on what fractionalized investing actually is and spreading the word that it’s available for real estate properties.

“I don’t view Arrived Homes or Landa as competitors. Rather, I view the stock market and the crypto market as competitors,” Yousefi said.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Investing – My Blog https://ift.tt/nkitslV

via IFTTT

Comments

Post a Comment