Investors are buying record amounts of insurance contracts to protect themselves from a sell-off that has already wiped trillions of dollars off the value of US stocks.

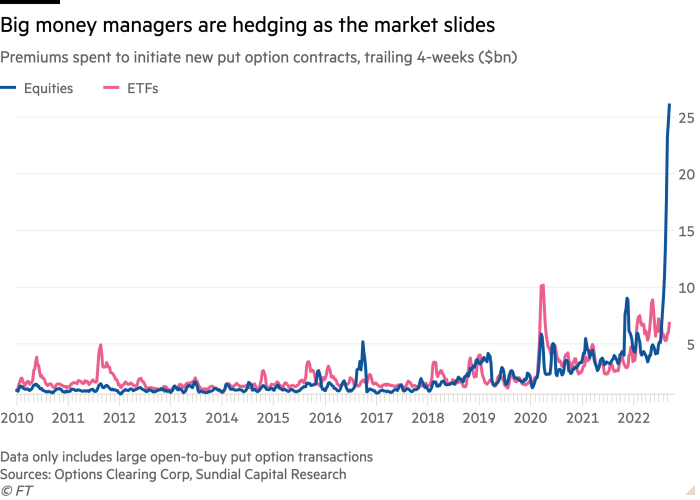

Purchases of put option contracts on stocks and exchange traded funds have surged, with big money managers spending $34.3bn on the options in the four weeks to September 23, according to Options Clearing Corp data analysed by Sundial Capital Research. The total was the largest on record in data going back to 2009, and four times the average since the start of 2020.

Institutional investors have spent $9.6bn in the past week alone. The splurge underscores the extent to which big funds want to insulate themselves from a sell-off that has dragged on for nine months, and has been supercharged by central bankers across the globe aggressively raising interest rates to tame high inflation.

“Investors have realised the [US] Federal Reserve is very policy constrained with inflation where it is and they can no longer count on it to manage the risk of asset price volatility, so they need to take more direct action themselves,” said Dave Jilek, chief investment strategist at Gateway Investment Advisors.

Jason Goepfert, who leads research at Sundial, noted that when adjusting for growth in the US stock market over the past two decades, the volume of equity put option purchases was roughly equivalent to the levels reached during the financial crisis. By contrast demand for call options, which can pay out if stocks rally, has tailed off.

While the sell-off has wiped more than 22 per cent off the benchmark S&P 500 stock index this year — pushing it into a bear market — the slide has been relatively controlled, lasting months, not weeks. That has frustrated many investors who hedged themselves with put options contracts or bet on a surge in the Cboe’s Vix volatility index but found the protection did not act as the intended shock absorber.

Earlier this month the S&P 500 suffered its biggest sell-off in more than two years but the Vix failed to breach 30, a phenomenon never before registered, according to Greg Boutle, a strategist with BNP Paribas. Generally large drawdowns push the Vix well above that level, he added.

Over the past month money managers have instead turned to buying put contracts on individual stocks, betting that they can better safeguard portfolios if they hedge against large moves in companies like FedEx or Ford, which have slid dramatically after issuing profit warnings.

“You’ve seen this extreme dislocation. It’s very rare you see this dynamic where put premiums in single stocks are bid so much relative to the index,” said Brian Bost, the co-head of equity derivatives in the Americas at Barclays. “That’s a large structural shift that doesn’t happen every day.”

Investors and strategists have argued that the slow slide in the major indices has in part been driven by the fact that investors had largely hedged themselves after declines earlier this year. Long-short equity hedge funds have also largely pared back their bets after a dismal start to the year, meaning many have not had to liquidate large positions.

As stocks dropped again on Friday and more than 2,600 companies hit new 52-week lows this week, Cantor Fitzgerald said its clients were taking profits on hedges and establishing new trades with lower strike prices as they put on fresh insurance.

Strategists across Wall Street have cut year-end forecasts as they factor in tighter policy from the Fed and an economic slowdown that they warn will soon begin to eat into corporate profits. Goldman Sachs on Friday lowered its S&P 500 forecast, expecting a further decline in the benchmark as it scrapped its bet on a late-year rally.

“The forward paths of inflation, economic growth, interest rates, earnings, and valuations are all in flux more than usual,” said David Kostin, a strategist at Goldman. “Based on our client discussions, a majority of equity investors have adopted the view that a hard landing scenario is inevitable.”

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Investing – My Blog https://ift.tt/PL2dcGX

via IFTTT

Comments

Post a Comment