Jonathan Kitchen

Every investor must learn the one investing lesson in surviving the long game: how math works. I recently received an email from a reader suggesting that the 2022 decline in the market is “no big deal” because of the stellar returns over the last decade. He quoted a snippet of an article by Ben Carlson.

To be fair, these losses need to be put into perspective. The gains leading up to this slaughter were gigantic. These are the annual returns for the Nasdaq since the Great Financial Crisis ended:”

- 2009: +45.3%

- 2010: +18.0%

- 2011: -0.8%

- 2012: +17.9%

- 2013: +40.9%

- 2014: +14.7%

- 2015: +7.0%

- 2016: +8.9%

- 2017: +29.6%

- 2018: -2.8%

- 2019: +36.7%

- 2020: +44.9%

- 2021: +22.2%

For those of you scoring at home, that’s returns of more than 20% per year for 13 years!

Ben’s math is correct. As such, the reader’s email suggests the 2022 drawdown is nothing to be concerned with because of gargantuan percentage returns in previous years. To be exact:

Yes, I gave up 2021 gains, but I still have all the previous years in the bank.”

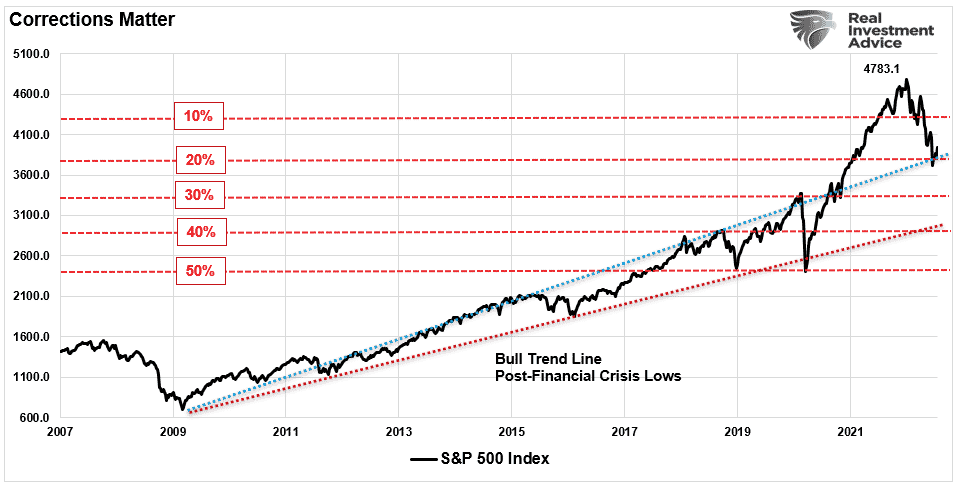

Unfortunately, that isn’t how math works; therein lies the investing lesson we must learn. As shown, corrections that seem small on a percentage basis can wipe out years of gains.

Author

Investing Lesson – How Math Works

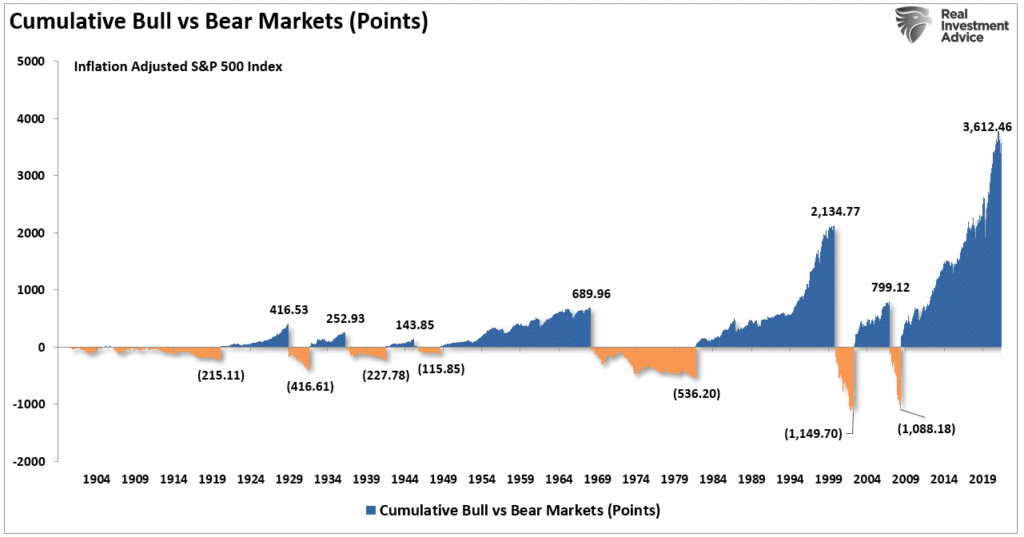

The following chart proves my point, in the long-term; bear markets are harmless (and relatively small) as the chart indicates.”

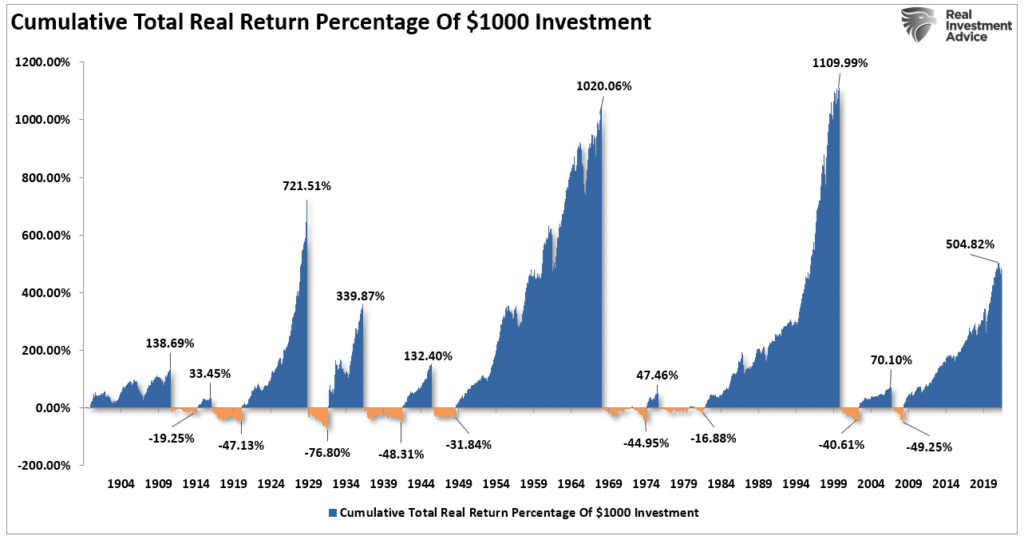

For data consistency, I recreated the “cumulative percentage return” chart that the reader provided from First Trust.

Robert Shiller; Chart by: Real Investment Advice

The problem is that your assumption is entirely wrong. The investing lesson buried in the chart above is the basic understanding of math. The chart uses percentage returns which is highly deceptive if you don’t examine the issue beyond a cursory glance. Let’s take a look at a quick example.

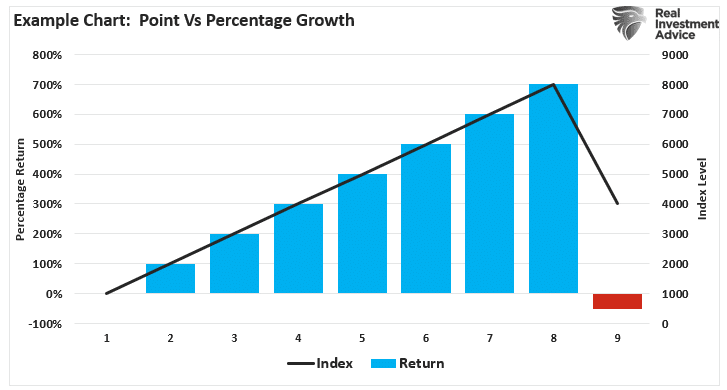

Let’s assume that an index goes from 1000 to 8000.

- 1000 to 2000 = 100% return

- The index rises to 3000 = 200% return

- Going on to 4000 = 300% return

- And continues to 8000 = 700% return

Great, an investor bought the index and generated a 700% return on their money.

Why worry about a 50% correction in the market when you just gained 700%. Right?

Here is the problem with percentages.

A 50% correction does not leave you with a 650% gain.

A 50% correction subtracts 4000 points, reducing your 700% gain to just 300%.

St. Louis Federal Reserve; Chart by: Real Investment Advice

As shown in the example, the small drawdown seems innocuous until you realize it clipped 4000 points from the index. The problem now becomes the issue of regaining those 4000 lost points to break even.

Understanding the math of loss is incredibly important.

The Math Can Be A Killer (Of Financial Goals)

When measuring markets in percentage terms, the math is very deceiving. Such is critical when you realize that a 100% gain and a 100% loss are the same.

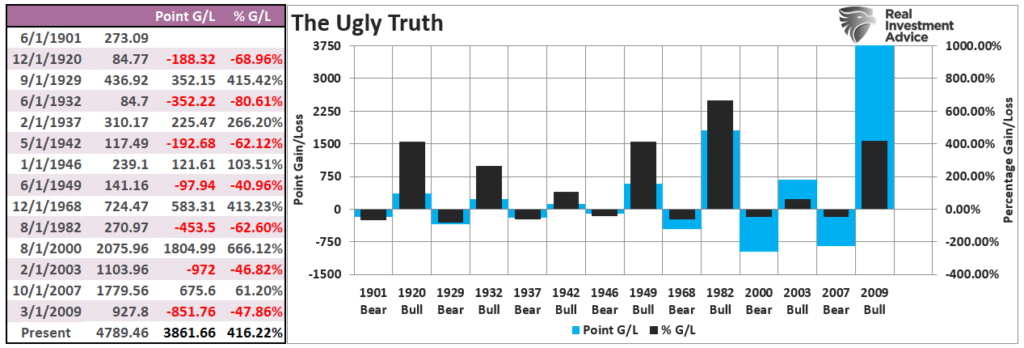

The chart below reconstructs the percentage gain and loss chart above into actual point changes. In this form, we see that most of the advances in bull markets get subsequently destroyed in bear markets.

Robert Shiller; Chart: Real Investment Advice

The chart and table below show the point and percentage gain or loss for each market cycle to clarify that point. Again, the “math” is straightforward. Bear markets are devastating to financial outcomes.

Robert Shiller; Chart: Real Investment Advice

As is always the case, the “math of loss” matters over the long term. Such is why after 3-major bull market cycles since 1980, most Americans are woefully unprepared for retirement.

The investing lesson investors have yet to learn is that capital preservation matters most in achieving long-term financial goals.

Time Matters

If you have discovered the secret to eternal life, stop reading now.

For the rest of us, mere mortals, time matters.

Unfortunately, most investors remain woefully behind their promised financial plans. Given current valuations and the ongoing impact of “emotional decision making,” the outcome will not likely improve over the next decade.

For investors, understanding potential returns from any given valuation point are crucial when considering putting their “savings” at risk. Risk is an important concept as it is a function of “loss.” The more risk in a portfolio, the greater the destruction of capital when reversions occur.

However, the real damage that market declines inflict on investors is all too real and virtually impossible to recover from. When investors lose money in the market, it is possible to regain the lost principal given enough time. However, therein lies “the rub.” We can never recover the “time” lost to reach our financial goals.

In the end, market corrections are very bad for your portfolio. However, before sticking your head in the sand and ignoring market risk based on an article touting “long-term investing always wins,” ask yourself who benefits?

This time is “not different.”

The clock on your retirement goals continues to tick… tick… tick.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

from Investing – My Blog https://ift.tt/5WvkZlu

via IFTTT

Comments

Post a Comment