The widespread vaccinations, easing travel restrictions, and manageable COVID cases indicate that better days are ahead for the travel industry and the companies associated with it.

However, macro headwinds (high inflation and rising interest rates) and their impact on consumer spending and the war in Europe continue to pose challenges.

Amid the uncertainty, let’s turn to TipRanks’ new Website Traffic tool to ascertain what’s in store for top travel-related stocks. This is important as the tool allows investors to analyze the changes in consumer behavior and predict the impact on their financials and stock price. Let’s begin.

Expedia leverages its tech-based platform to offer travel-related solutions. The pandemic and measures to control the spread of the virus negatively impacted consumers’ demand and ability to travel, which in turn took a toll on the company’s financials.

However, as travel restrictions have been lifted in almost all countries and consumers have become more comfortable traveling, Expedia is witnessing a moderation in the elevated cancellation rates and declines in travel bookings.

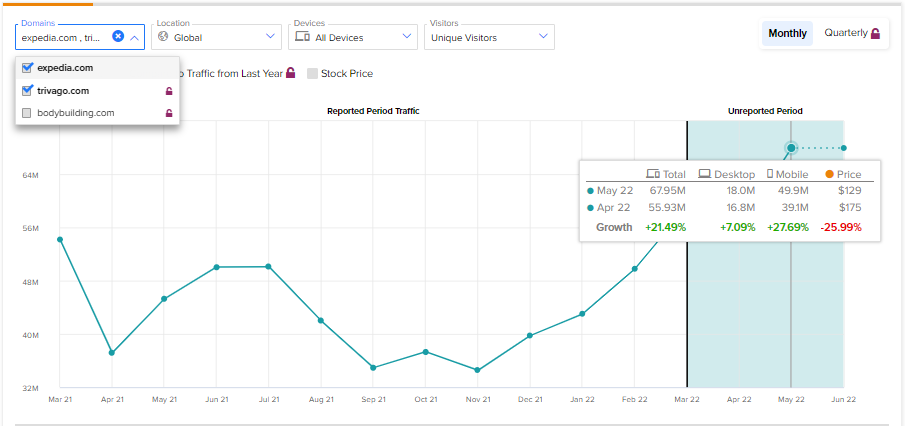

Things are improving for Expedia, as revealed by TipRanks’ Website Traffic tool. Per the tool, the number of visits to expedia.com and its other website (trivago.com) is up 21.5% month-over-month in May. Year-to-date, the website traffic has grown 27.5% compared to last year’s period. Further, compared to Q1, website traffic is trending 33.6% higher in Q2 so far, which is positive.

During the Q1 conference call, Expedia CEO, Peter Kern, stated that the company is keeping an eye on various macro factors, including inflation and the Russia/Ukraine war. Moreover, it is witnessing “positive indicators for a strong recovery in leisure travel this summer.”

He added that international, business, and city travel demand is recovering, which bodes well for future growth. These indicate that Expedia could deliver strong financials in Q2.

EXPE stock sports a Moderate Buy consensus rating on TipRanks, based on 12 Buy and 12 Hold recommendations. Moreover, the average Expedia price target of $190.82 implies 88.6% upside potential.

Booking Holdings offers internet-based travel and related services in more than 220 countries through its six consumer-facing brands. Its financial results and prospects are dependent on the sale of travel-related services. Thus, a surge in travel demand could boost its financials and stock price.

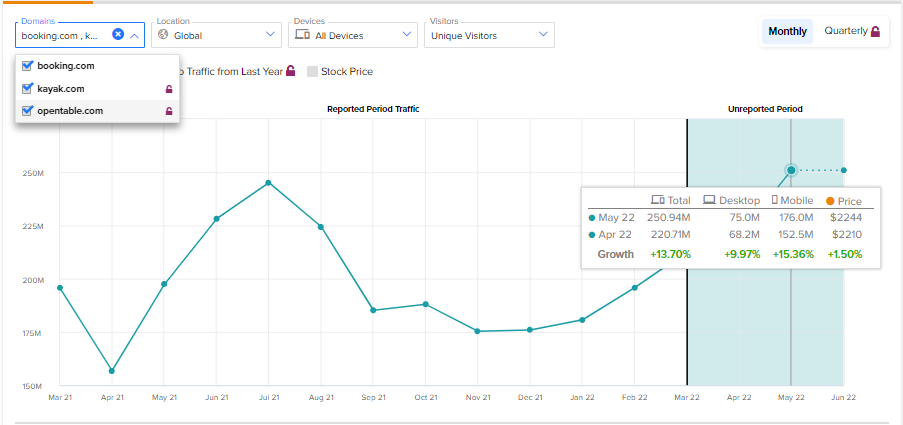

TipRanks’ Website Traffic tool indicates improving demand trends for BKNG’s offerings. According to the tool, the number of visits to booking.com and its two other websites increased by 13.7% month-over-month in May. Further, on a year-to-date basis, the website traffic has grown 10.9% compared to last year. Moreover, website traffic is up 22.6% so far in Q2 as compared to Q1.

The improving website traffic trends are positive. Meanwhile, Booking Holdings’ CEO, Glenn Fogel, is upbeat about Q2. During the Q1 conference call, Fogel stated that global travel trends have strengthened so far in Q2 despite an uncertain macroeconomic environment. Moreover, he added, the company is preparing “for a busy summer travel season ahead.”

Improving website traffic and favorable management commentary indicate that BKNG could deliver a robust set of financial numbers in Q2.

BKNG stock has received 17 Buy and seven Hold recommendations for a Moderate Buy consensus rating. Moreover, the average Booking Holdings price target of $2,682.86 implies 41.5% upside potential.

Hyatt Hotels (NYSE: H)

Leading global hospitality company Hyatt is benefitting from a continued recovery in leisure demand and momentum in group and business transient travel.

Further, TipRanks’ Website Traffic tool indicates that the momentum in its business could be sustained in Q2. Notably, the website traffic at hyatt.com has increased by 10.2% month-over-month in May. Year-to-date, the number of website visits has grown 32.6% compared to last year. Moreover, website traffic is 16.8% higher so far in Q2 than in Q1.

Recently, Hyatt announced that its comparable system-wide RevPAR (revenue per available room and a key performance metric) was $127 in May, the strongest RevPAR performance for an individual month since November of 2019. The company added that the business transient and group revenue also strengthened in May.

The company added that the ongoing momentum in demand and favorable forward booking trends indicate a robust summer travel season ahead.

Hyatt stock has received two Buy and seven Hold recommendations for a Hold consensus rating. Moreover, the average Hyatt price target of $94.25 implies 22.1% upside potential.

Bottom Line

The easing travel restrictions, improving website traffic trends, and strong demand indicate better days for these companies. However, the uncertain macro environment could play spoilsport.

Comments

Post a Comment